The Truth About Credit Scores and Buying a Home

Your credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding some buyers back.

The Myth: You Need To Have Perfect Credit

According to Fannie Mae , only 32% of potential homebuyers have a good idea of what credit score lenders actually require.

That means two-thirds of buyers don’t actually know what lenders are looking for – and most overestimate the minimum credit score needed.

The Reality: Perfect Isn’t Necessary

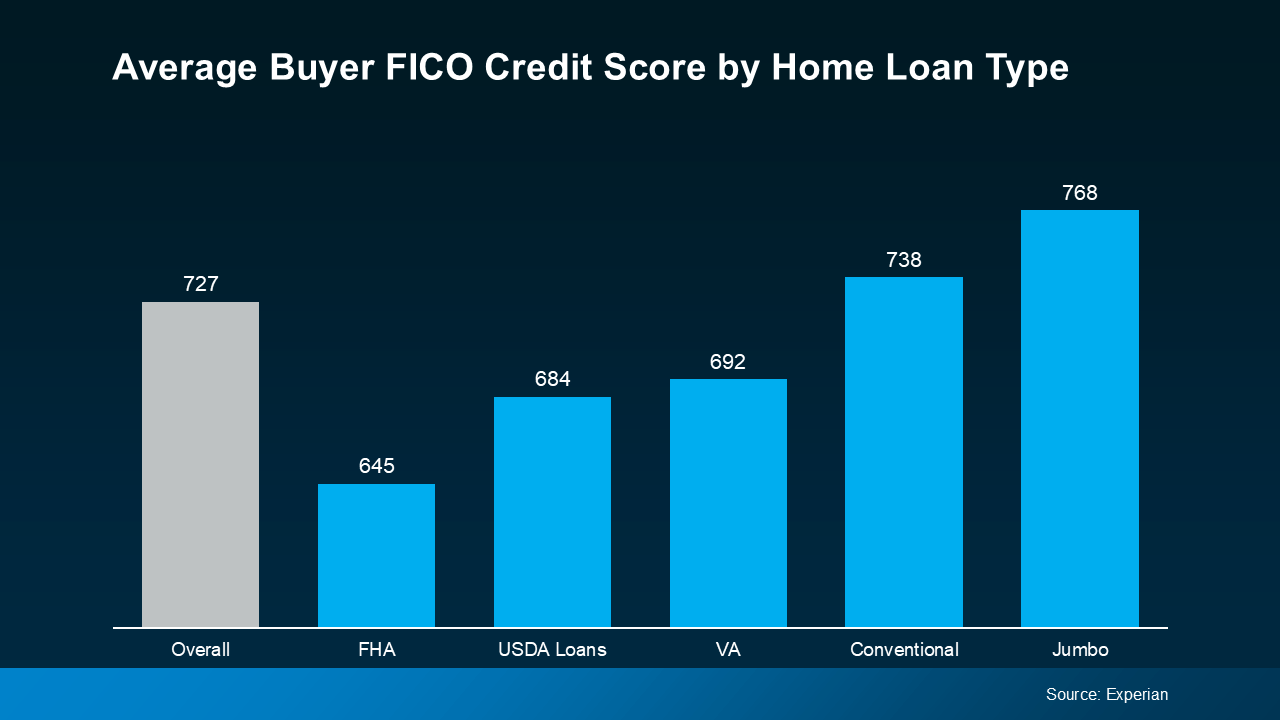

But the truth is, you don’t need perfect credit to become a homeowner . To see the average score, by loan type, for recent homebuyers check out the graph below:

There is no set cut-off score across the board. As FICO explains

:

There is no set cut-off score across the board. As FICO explains

:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .”

So, even if your credit score isn’t as high as you’d like, you may still be able to get a home loan. Just know that, even though you don’t need perfect credit to buy a home , your score can have an impact on your loan options and the terms you’re able to get.

Work with a trusted lender who can walk you through what you’d qualify for.

Simple Tips To Improve Your Credit Score

If you want to open up your options a bit more after talking to a lender, here are a few tips from Experian and Freddie Mac that can help give your score a boost:

1. Pay Your Bills on Time

This includes everything from credit cards to utilities and other monthly payments. A track record of on-time payments shows lenders you’re responsible and reliable.

2. Pay Down Outstanding Debt

Reducing your overall debt not only improves your credit utilization ratio (how much credit you’re using compared to your total limit) but also makes you a lower-risk borrower in the eyes of lenders. That makes them more likely to approve a loan with better terms.

3. Hold Off on Applying for New Credit

While opening new credit accounts might seem like a quick way to boost your score, too many applications in a short period can have the opposite effect. Focus on improving your existing accounts instead.

Bottom Line

Your credit score doesn’t have to be perfect to qualify for a home loan. The best way to know where you stand? Work with a trusted lender to explore your options.